Our Life Lived Well Wealth Management System

Life is full of priorities. Your financial plan should be built around yours.

Whether it’s securing a comfortable retirement, paying for a child’s education, or purchasing a second home, we all have competing short and long-term goals that require a personalized plan to be successful.

With sound planning, we can all get a little more out of life by spending more time focused on what’s important to us and less time being concerned about finances.

We are a life-centered advisory practice.

We don’t believe the Standard & Poor’s is the right index against which your life should be measured. Rather our Life Lived Well system measures success based on how well your money is helping you live a life focused on your priorities.

With innovative and collaborative planning tools, we can help you create a realistic plan designed to meet your goals.

Once we have a baseline plan, we will thoroughly test the plan and gauge the probability of success. We will discuss priorities and look at other options to improve your odds.

Learn how we can help you design a personalized plan to meet your financial goals.

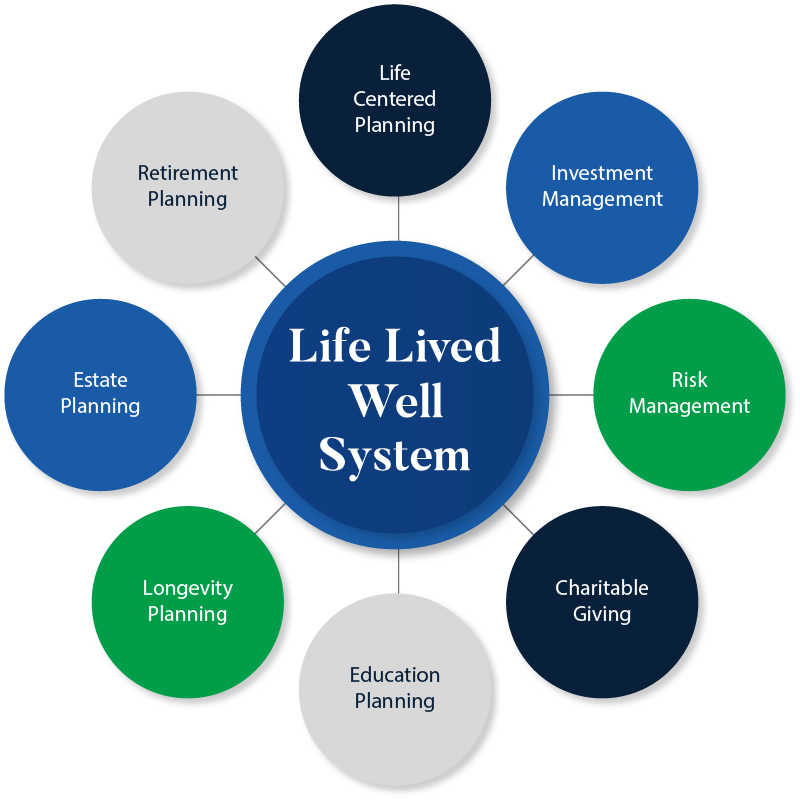

Our Life Lived Well System

We follow a disciplined system to assess your circumstances and design personalized planning and investment strategies that meet your objectives.

Our Life Lived Well system combined with the Life Lived Well 5-Step Process make up our advisory process.

We spend our lives planning . . . for our next vacation, for a family, for retirement. Being able to realize our plans requires objectives, information, organization, and compromise. Successful plans will also require a significant degree of financial planning.

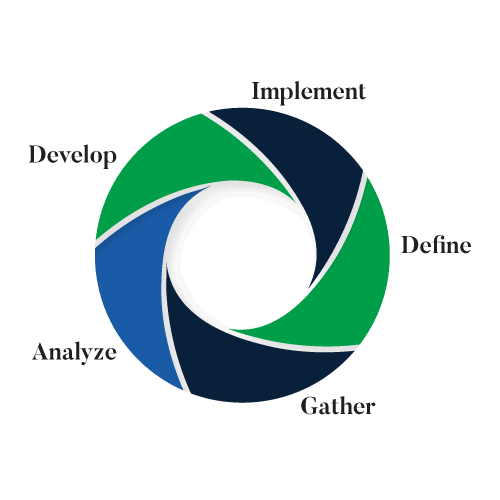

We follow our 5-step Life Lived Well process to significantly increase the potential of developing a winning financial plan. This ongoing process allows us to continually update and adjust the plan as life happens.

Step 1: Defining and agreeing on your financial objectives and goals

Your goals and objectives will be the guide to the financial plan and should provide a roadmap for your financial future. They contain the following features:

- Fiscalosophy

- Return on Life Index

- Smart Goals

- Separate your needs from your wants

** We are one of five offices in the state of Colorado to use the Return on Life system to supplement our Life Lived Well system. The Return on Life system is a way that we ensure your best interests and goals are taken into account.

Step 2: Gathering your financial and personal information

The planning process and its success will depend on the quality and clarity of the information. Your attitude, tolerance and capacity for risk are assessed using RiskAlyze’s psychometrically designed risk tolerance questionnaire in relation to investment assets. This is also analyzed to assess your asset allocation of investments.

We complete a detailed financial fact-find to capture all relevant information in relation to your finances, including:

- Income and expenditure

- Assets and liabilities

- Risk attitude, tolerance, and capacity

Step 3: Analyzing your financial and personal information

We analyze the information gathered and use it to produce a report that reflects your current financial profile.

The following ratios are produced to improve your understanding of your financial circumstances and to pinpoint areas of strength or weakness:

- Probability of Success Ratio

- Liquidity Ratio

- Savings Ratio

- Debt Service Ratio

Step 4: Development and presentation of the financial plan

The financial plan is developed based on the information received in steps one and two. The analysis is completed in step three.

Each of the goals and objectives in step one should be addressed and a recommendation for each identified. It will include:

- Net worth statement (a balance sheet)

- Annual consolidated tax calculation

- Annual cash flow report (displaying surplus or deficit)

The report is presented, explained, discussed, and saved.

Step 5: Implementation and review of the financial plan

Once the analysis and development of the plan is complete, we outline the recommended courses of action.

This can involve implementing:

- A new savings or investment strategy

- Consolidating investment providers

- Risk management vehicles

- Income and expenditure adjustments

Financial planning is an on-going process that requires continuous monitoring. Review of the actions recommended in the plan should take place regularly, and the goals should be reviewed annually to take account of a change in income, asset values, business, or family circumstances.