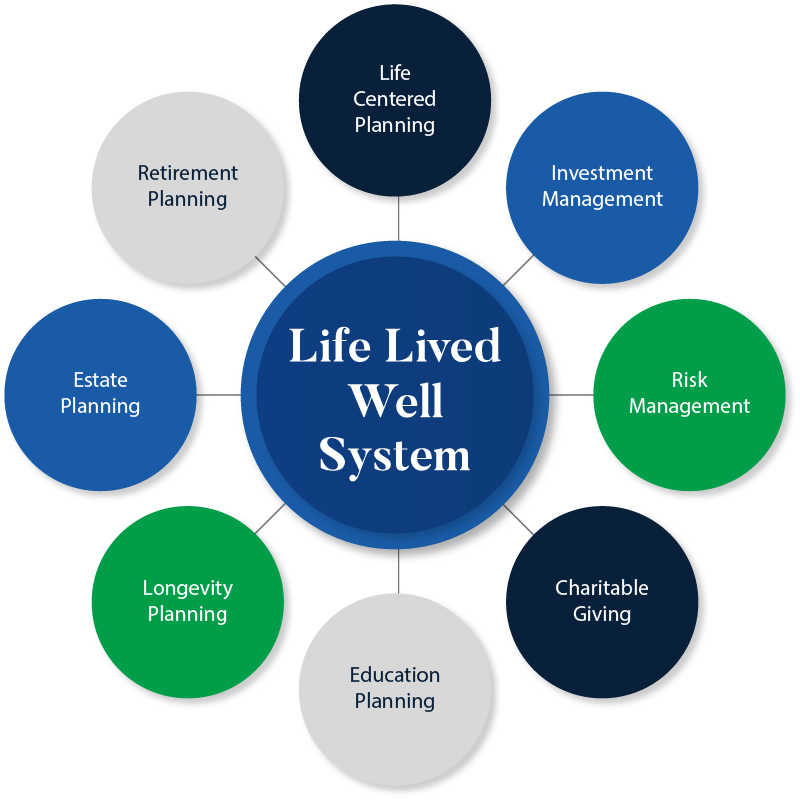

Our Life Lived Well Wealth Management System

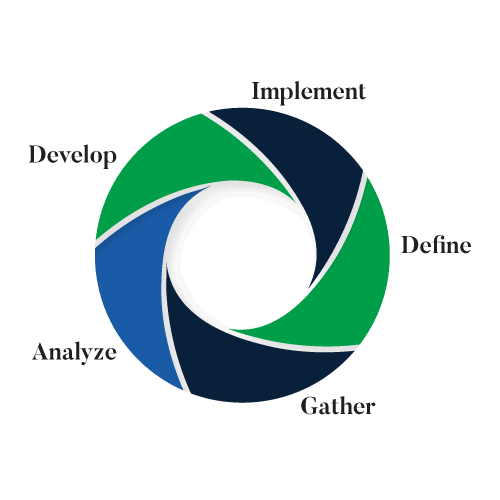

We follow a disciplined system to assess your circumstances and design personalized planning and investment strategies to meet your objectives. Our Life Lived Well system combined with the Life Lived Well 5-Step Process make up our advisory process.

We spend our lives planning . . . for our next vacation, for a family, for retirement. Being able to realize our plans requires objectives, information, organization, and compromise. Successful plans will also require a significant degree of financial planning. We follow our 5-step Life Lived Well process to significantly increase the potential of developing a winning financial plan. This ongoing process allows us to continually update and adjust the plan as life happens.

Step 1: Defining and agreeing on your financial objectives and goals

Your goals and objectives will be the guide to the financial plan and should provide a roadmap for your financial future. They contain the following features:

- Fiscalosophy

- Return on Life Index

- Smart Goals

- Separate your needs from your wants

** We are one of five offices in the state of Colorado to use the Return on Life system to supplement our Life Lived Well system.

Step 2: Gathering your financial and personal information

The planning process and its success will depend on the quality and clarity of the information. Your attitude, tolerance and capacity for risk are assessed using RiskAlyze’s psychometrically designed risk tolerance questionnaire in relation to investment assets. This is also analyzed to assess your asset allocation of investments.

We complete a detailed financial fact-find to capture all relevant information in relation to your finances, including:

- Income and expenditure

- Assets and liabilities

- Risk attitude, tolerance, and capacity

Step 3: Analyzing your financial and personal information

We analyze the information gathered and use it to produce a report that reflects your current financial profile. The following ratios are produced to improve your understanding of your financial circumstances and to pinpoint areas of strength or weakness:

- Probability of Success Ratio

- Liquidity Ratio

- Savings Ratio

- Debt Service Ratio

Step 4: Development and presentation of the financial plan

The financial plan is developed based on the information received in steps one and two and analysis completed in step three. Each of the goals and objectives in step one should be addressed and a recommendation for each identified. It will include:

- Net worth statement (a balance sheet)

- Annual consolidated tax calculation

- Annual cash flow report (displaying surplus or deficit)

The report is presented, explained, discussed, and catalogued.

Step 5: Implementation and review of the financial plan

Once the analysis and development of the plan is complete, we outline the recommended courses of action. This can involve implementing:

- A new savings or investment strategy

- Consolidating investment providers

- Risk management vehicles

- Income and expenditure adjustments

Financial planning is a dynamic on-going process that requires continuous monitoring. Review of the actions recommended in the plan should take place regularly, and the goals should be reviewed annually to take account of a change in income, asset values, business, or family circumstances.

Our Transparent Fees

Ongoing Wealth Management

This is our core service and for those who value comprehensive planning. We utilize our proprietary Life Lived Well process for an annual fee based on assets managed. Fees are charges on a quarterly basis.

Stand Alone Consultations

With limited availability, we offer consultations for people interested in short-term engagements. Our hourly rate for these services is $450/hr. with a 6.5-hour minimum. For those who are interested in a one-time Life Lived Well Financial Plan℠ that they can execute on their own the cost is $3000.

What do you receive for this fee?

- Always acts transparently and in good faith.

- Minimizes conflicts of interest and discloses any that exist.

- Always place your interest above ours.

According to a study by Russell Investments, it is clear that the value an advisor delivers to clients materially exceeds the 1% fee they typically charge for their services.

The study calculated the value of an advisor at 4.08% of assets managed.

We add value by keeping the cost of the funds in your portfolio low, rebalancing when appropriate, minimizing turnover costs in the funds we select, using academic data to understand dimensions of expected returns, behavioral coaching to close the gap between actual returns of mutual funds and those earned by our clients, tax efficient asset location, and tax efficient withdrawal strategies.

Prior to engaging us, we provide full disclosure of your cost.

In a fee-based account, clients pay a quarterly fee, based on the level of assets in the account, for the services of a financial advisor as part of an advisory relationship. In deciding to pay a fee rather than commissions, clients should understand that the fee may be higher than a commission alternative during periods of lower trading. Advisory fees are in addition to the internal expenses charged by mutual funds and other investment company securities. To the extent that clients intend to hold these securities, the internal expenses should be included when evaluating the costs of a fee-based account. Clients should periodically re-evaluate whether the use of an account-based fee continues to be appropriate in servicing their needs. A list of additional considerations, as well as the fee schedule, is available in the firm’s Form ADV Part II as well as the client agreement.